Welcome back to The VC Corner, your weekly dose of Venture Capital and Startups to keep you up and running! 🚀

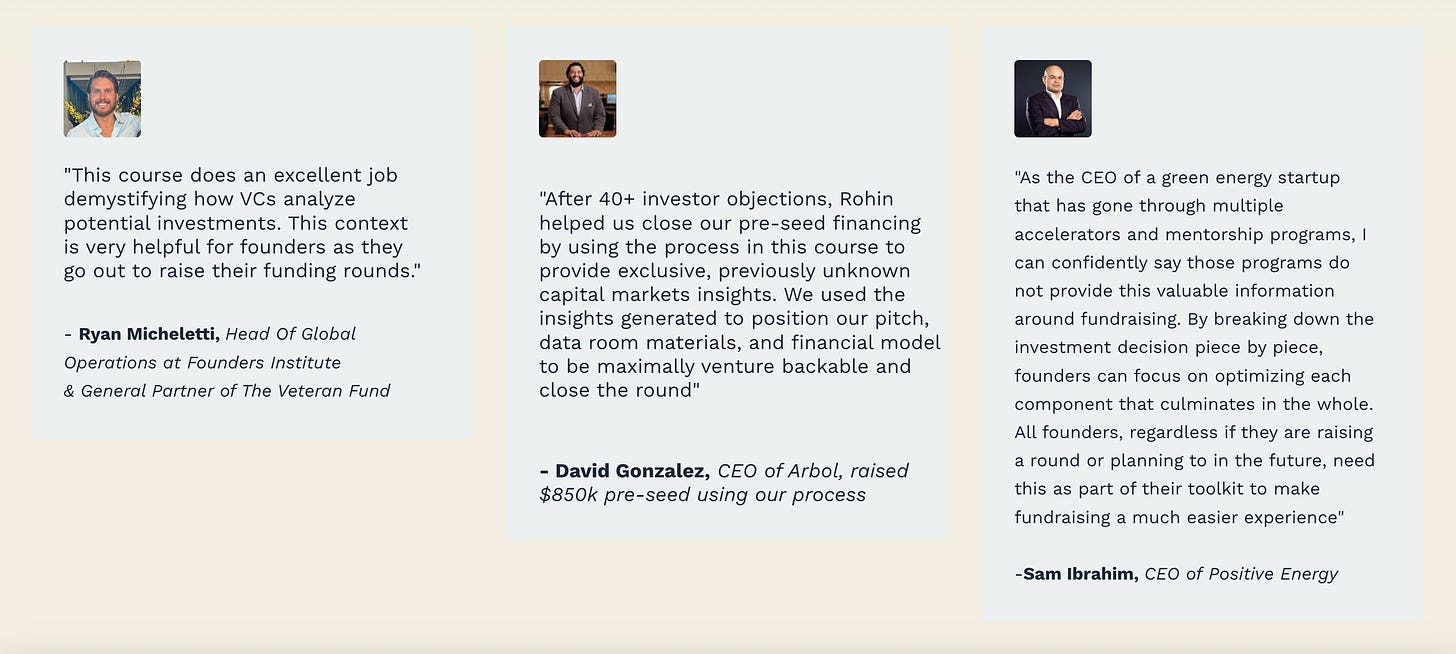

Myth: Fundraising is many "no's" before a "yes."

Acopia Ventures’s novel process, from inside 15+ venture funds, helps startups maximize their fund-ability in under two days, reducing investor objections by 70%+ and fundraising time to under 2.5 months.

Old workflow:

Prepare materials

Pitch and receive generic objections

Adjust and repeat, hoping for a “yes”

New:

Optimize your startup for invest-ability using our insider VC info

Target specific investors

Secure commitments faster

In-Depth Insights 🔍

The End of the VC Market. 📉 Brain Invest explores the factors leading to the predicted end of the VC market as we know it.

How to Start Your Own VC Fund. 💡 NFX offers a detailed guide for aspiring VCs looking to launch their own fund.

Navigating Marketplace Challenges: Top 5 Hurdles VCs See and How to Fix Them. 🔧 EU-Startups highlights the major obstacles marketplace startups face, as identified by VCs, and offers strategies for overcoming them.

Resignation Letter. 📝 An interesting resignation letter from Jerry Neumann, diving into personal reflections on venture capital.

📣Want to get your brand in front of 100k founders and investors?

If interested in sponsoring The VC Corner, reach out via email: rdominguezibar@gmail.com

Interesting Reports 📊

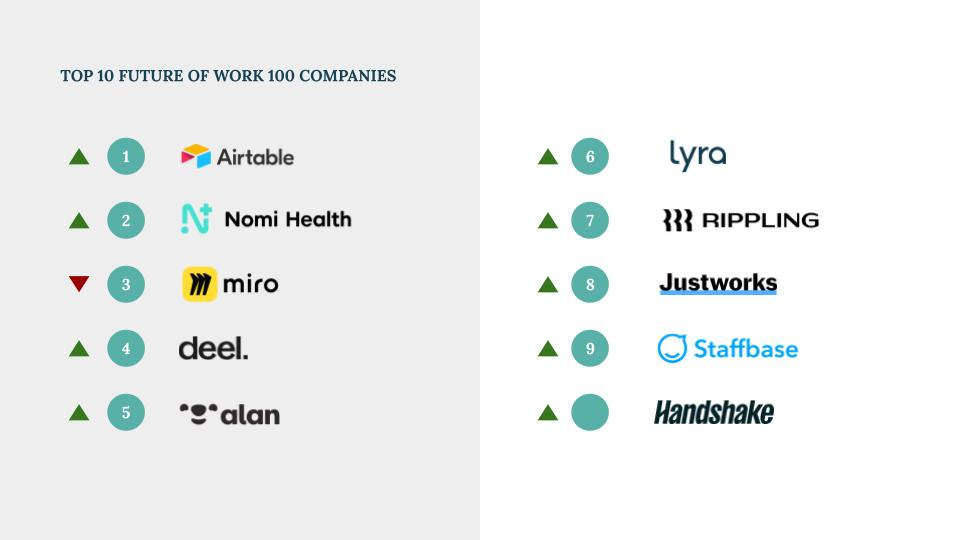

The Future of Work. 💻 Acadian Ventures explores the key trends shaping the future of work, focusing on the digital transformation of the workplace.

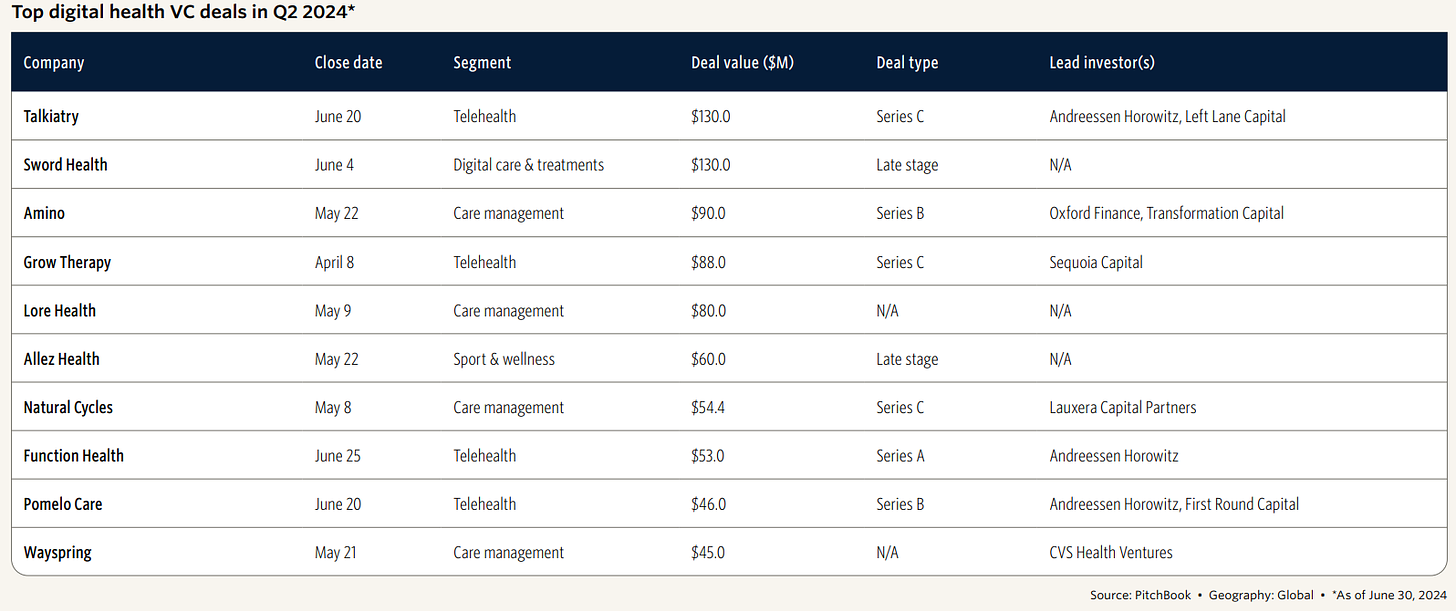

Q2 2024 Digital Health Report. 🏥 PitchBook's analysis of the latest developments in the digital health sector, providing insights into market trends and investment opportunities.

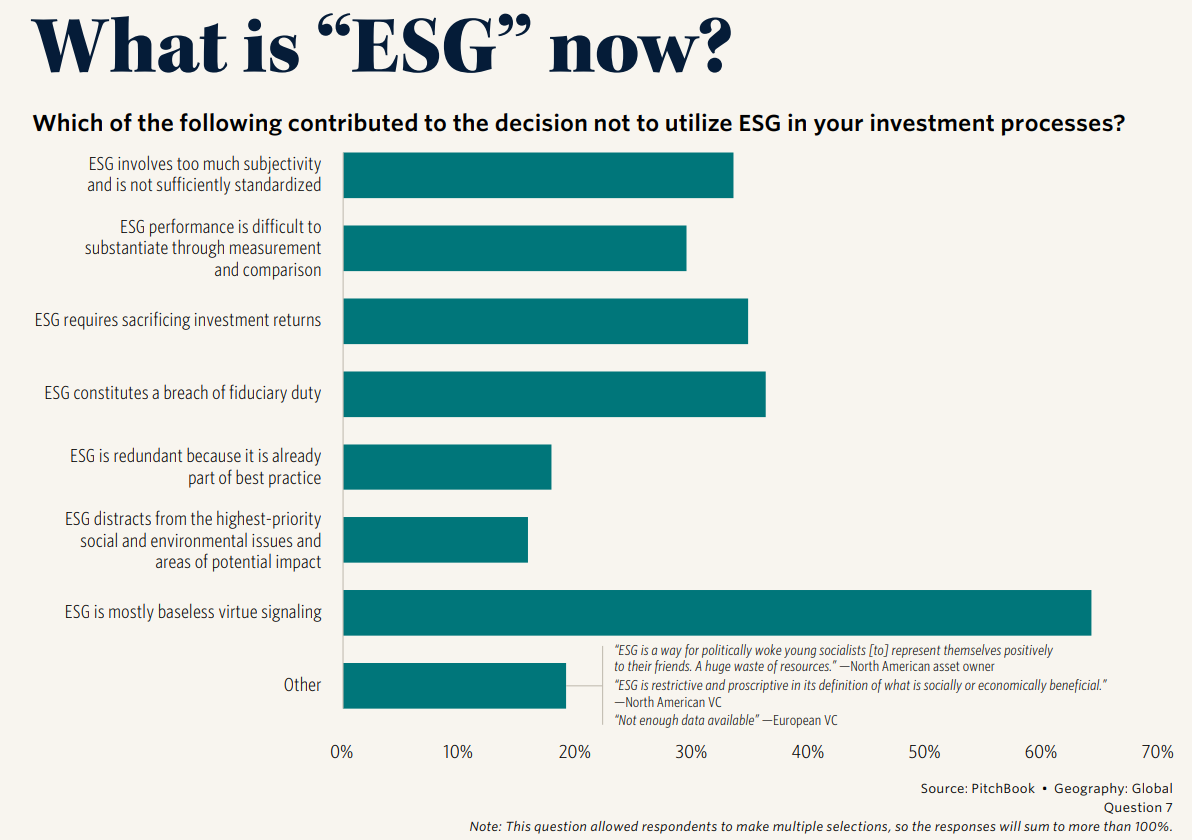

2024 Sustainable Investment Survey. 🌱 PitchBook's survey highlights key trends and challenges in sustainable investment for 2024.

Recently Launched Funds 💸

Costanoa Ventures launches a partnership-focused fund to invest in startups leveraging ecosystems for growth.

European Investment Fund and Hungarian National Capital Holding launch a €40M VC fund to back startups in Hungary.

Sabadell Asabys II closes at €180M to invest in health tech startups.

Boldstart Ventures raises $250M for its seventh fund to invest in B2B startups.

ARCH Venture Partners closes over $3B for a biotech-focused fund.

Headline announces the launch of its growth strategy, targeting investments in fast-scaling startups.

BlackRock, Global Infrastructure Partners, Microsoft, and MGX collaborate on a new AI-focused fund to drive innovation in infrastructure.

Atomico closes $1.24B across multiple funds to continue supporting European startups.

ERA Ventures launches with an initial $88M fund to back early-stage ventures.

Hottest Deals 💥

Alan reaches a $4.5 billion valuation with its latest funding round to expand its health insurance offerings

Mendaera raises $73M in Series B funding to advance robotic healthcare solutions

Utility Global secures $53M in Series C financing to scale its energy solutions

UJET raises $76M in Series D funding to grow its customer support solutions

Cyclic Materials raises $53M in Series B to scale its circular economy solutions

Distribusion raises $80M in Series C to expand its global travel distribution platform

GeneSpire raises €46.6M in Series B funding to advance its gene therapy solutions

Qure.ai secures $65M in Series D funding to expand its AI-powered healthcare solutions

Dandelion Energy raises $40M in Series C funding to scale its geothermal energy systems

Torq secures $70M in Series C funding to accelerate its automation platform for security teams

Whatfix raises $125M in Series E funding to scale its digital adoption platform

VC Jobs 💼

VC Investor @ Topology Ventures (Remote): Join Topology Ventures as a remote VC Investor, sourcing deals and supporting investment decisions.

VC Scout @ GetFresh Ventures (Remote): Work as a VC Scout for GetFresh Ventures, helping identify early-stage investment opportunities.

VC Specialist @ MicroVentures (Austin, TX): Join the MicroVentures team as a VC Specialist, focused on deal sourcing and portfolio management.

VC Principal @ Forbion (Boston, MA): Forbion is looking for a VC Principal to help lead investment strategy and manage portfolio companies.

VC Associate @ Toyota Ventures (Los Altos, CA): Join Toyota Ventures as a VC Associate, helping with deal sourcing, due diligence, and portfolio management.

VC Fellowship @ Forbion (Netherlands): Apply for a fellowship at Forbion, gaining experience in venture capital through hands-on work with their team.

VC Internship @ In-Q-Tel (Washington, DC): Gain hands-on venture capital experience at In-Q-Tel as an intern, assisting in deal sourcing and analysis.

VC Associate @ Starlight Ventures (Miami, FL): Join Starlight Ventures as a VC Associate, focusing on sourcing deals and supporting portfolio companies.

VC Internship @ Serena (Remote): Serena is looking for a remote VC intern to assist with market research and deal analysis.

VC Analyst @ The Aligned Fund (Remote): The Aligned Fund is seeking a VC Analyst to support investment decisions and conduct in-depth market research.

Incredible, I love this edition!

Incredible, I love this edition!