In the opaque world of venture capital, true transparency is a rarity. While some investors might share their criteria for investments, they seldom reveal the detailed reasoning behind their decisions.

However, the YouTube investment memo by Sequoia Capital, authored by Roelof Botha in 2005, offers a rare glimpse into this secretive process. This memo, made public due to the Viacom vs. Google (YouTube) lawsuit, provides an unfiltered look at one of the most consequential investment decisions in Silicon Valley history.

This memo is particularly valuable because of its authenticity. Unlike the polished documents that firms sometimes release for public consumption, this one was disclosed in a legal filing, capturing Sequoia’s raw and unvarnished analysis. It documents Botha’s recommendation to invest $1 million in YouTube’s seed round, followed by a $4 million Series A—a move that ultimately led to YouTube’s $1.65 billion acquisition by Google just a year later.

For anyone curious about how top-tier venture capital firms make decisions, this memo is a goldmine. It not only outlines the strategic thinking that led Sequoia to back YouTube but also highlights the disciplined approach the firm takes in managing risk and aligning its interests with those of the entrepreneurs it supports. What stands out most is the memo’s candid assessment of both the opportunities and the risks, offering a masterclass in venture capital decision-making.

Index

The Power of a Simple Thesis

How Roelof Botha identified YouTube’s potential as the leading platform for user-generated video content.

The Deal Structure: A Balanced Risk

Sequoia’s strategic approach to structuring its investment in YouTube.

Competition and Defensibility

The importance of product development and building a defensible position in the market.

Key Risks

An honest assessment of the uncertainties surrounding YouTube’s monetization and scalability.

Final Recommendation

Botha’s conviction and rationale behind proceeding with the investment in YouTube.

Lessons for Today’s Investors

Timeless principles in venture capital drawn from Sequoia’s investment in YouTube.

Includes access to the full YouTube investment memo

1. The Power of a Simple Thesis

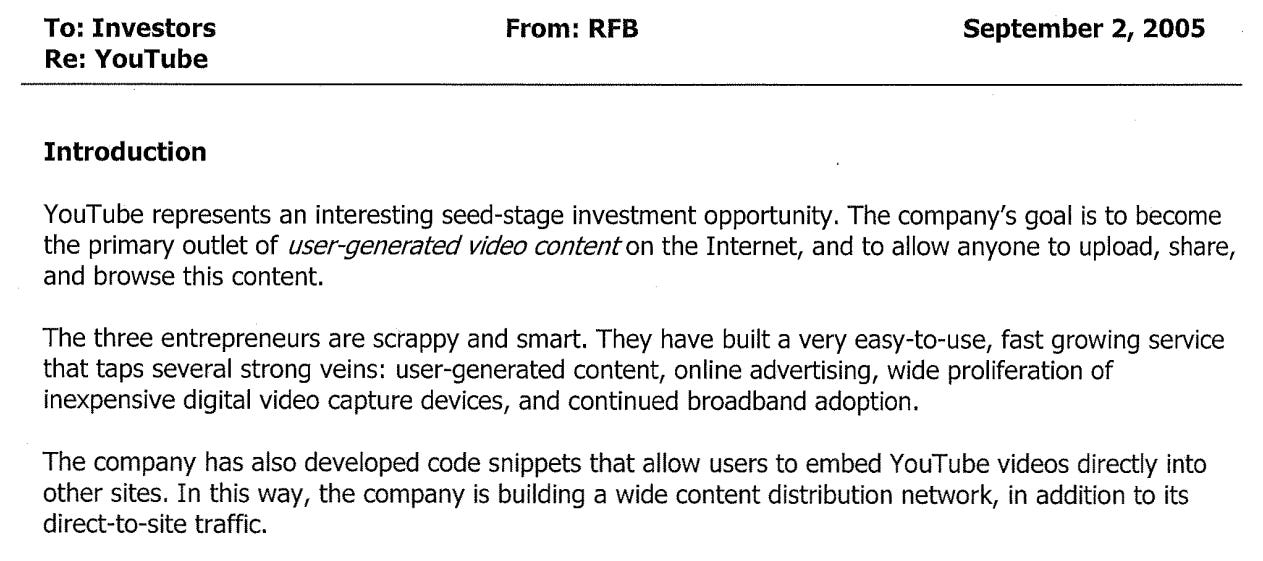

In the opening section of the memo, Botha succinctly lays out his primary thesis: YouTube has the potential to become the "primary outlet of user-generated video content on the Internet." At the time, this was a bold and somewhat unconventional prediction. Video content on the web was still in its infancy, and the concept of user-generated content was far from mainstream. However, Botha identified several macro trends—such as the proliferation of inexpensive digital video capture devices and continued broadband adoption—that would support YouTube’s growth.

What's striking about Botha's approach is the confidence with which he presents his thesis without overexplaining it. He doesn’t attempt to defend these foundational premises extensively; instead, he trusts that the trends are self-evident to his colleagues.

2. The Deal Structure: A Balanced Risk

If you're enjoying the free content, consider upgrading to a paid subscription. This will grant you access to the full YouTube investment memo, an in-depth analysis of Sequoia's strategic thinking, and the complete archive of articles published on The VC Corner.

Keep reading with a 7-day free trial

Subscribe to The VC Corner to keep reading this post and get 7 days of free access to the full post archives.