Hey there! Welcome back to The VC Corner. Today, we're diving into one of the most critical documents in the fundraising process: the term sheet. Whether you're a VC investor, a first-time founder, or a seasoned entrepreneur, understanding the key elements of a term sheet can significantly impact your negotiation strategy and, ultimately, your success.

Table of Contents

What is a Term Sheet?

Key Components of a Term Sheet

2.1 Investment Amount and Valuation

2.2 Liquidation Preference

2.3 Dividends

2.4 Conversion to Common Stock

2.5 Voting Rights

2.6 Drag-Along Rights

2.7 Other Rights and Matters

2.8 Board Composition

2.9 Founder and Employee Vesting

2.10 No-Shop Clause

Conclusion

What is a Term Sheet?

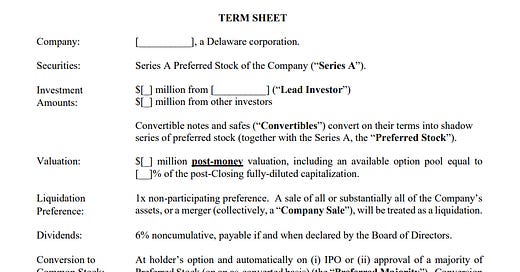

A term sheet is a non-binding agreement that outlines the basic terms and conditions under which an investment will be made. Think of it as a roadmap for both the investor and the founder, setting the stage for the final investment agreement. It's essential for both parties to have a clear understanding of what "good" looks like in a term sheet to ensure a fair and beneficial deal.

This article is based on the Series A term sheet template provided by Y Combinator, which reflects standard terms commonly seen in Silicon Valley.

Key Components of a Term Sheet

1. Investment Amount and Valuation

Investment Amount: This specifies the total amount of money being invested into the company. For example, a term sheet might state, "The Lead Investor will invest $5 million."

Valuation: This includes the post-money valuation of the company, which is the company's value after the investment. It might read, "The company is valued at $20 million post-money."

Example: A lead investor proposes to invest $5 million in your startup, with a post-money valuation of $20 million.

2. Liquidation Preference

This term defines how proceeds from a sale or liquidation of the company will be distributed. A common structure is a 1x non-participating preference, meaning investors get their money back first, but do not participate in any remaining proceeds.

Example: If your startup is sold, the investor gets back their $5 million investment first before any other proceeds are distributed.

3. Dividends

Dividends can be cumulative or non-cumulative. A typical term might specify a 6% non-cumulative dividend, payable when declared by the board.

Example: Investors are entitled to a 6% annual dividend, which is paid out when and if the board decides.

4. Conversion to Common Stock

Keep reading with a 7-day free trial

Subscribe to The VC Corner to keep reading this post and get 7 days of free access to the full post archives.