Welcome to The VC Corner, your weekly dose of Venture Capital and Startups to keep you up and running! 🚀

The Creator MBA: Build a lean, profitable internet business in 2024

The Creator MBA delivers a complete blueprint for starting, building,

and sustaining a profitable Internet business.

This course by Justin Welsh includes a full framework for coming up with business ideas, understanding why and how people buy, developing and testing offers, getting attention, building your email list, pitching, converting, and much more.

If you're looking for a complete, tried-and-true system that you can use to build and grow the online business you’ve always wanted, this is it. Use code “CPD61621” to get 20% off! Check it here.

In-Depth Insights 🔍

Playing to Win vs. Playing to Make Plan: The Two Very Different Worlds of Silicon Valley. Things have changed 🌟 [Dave Kellogg]

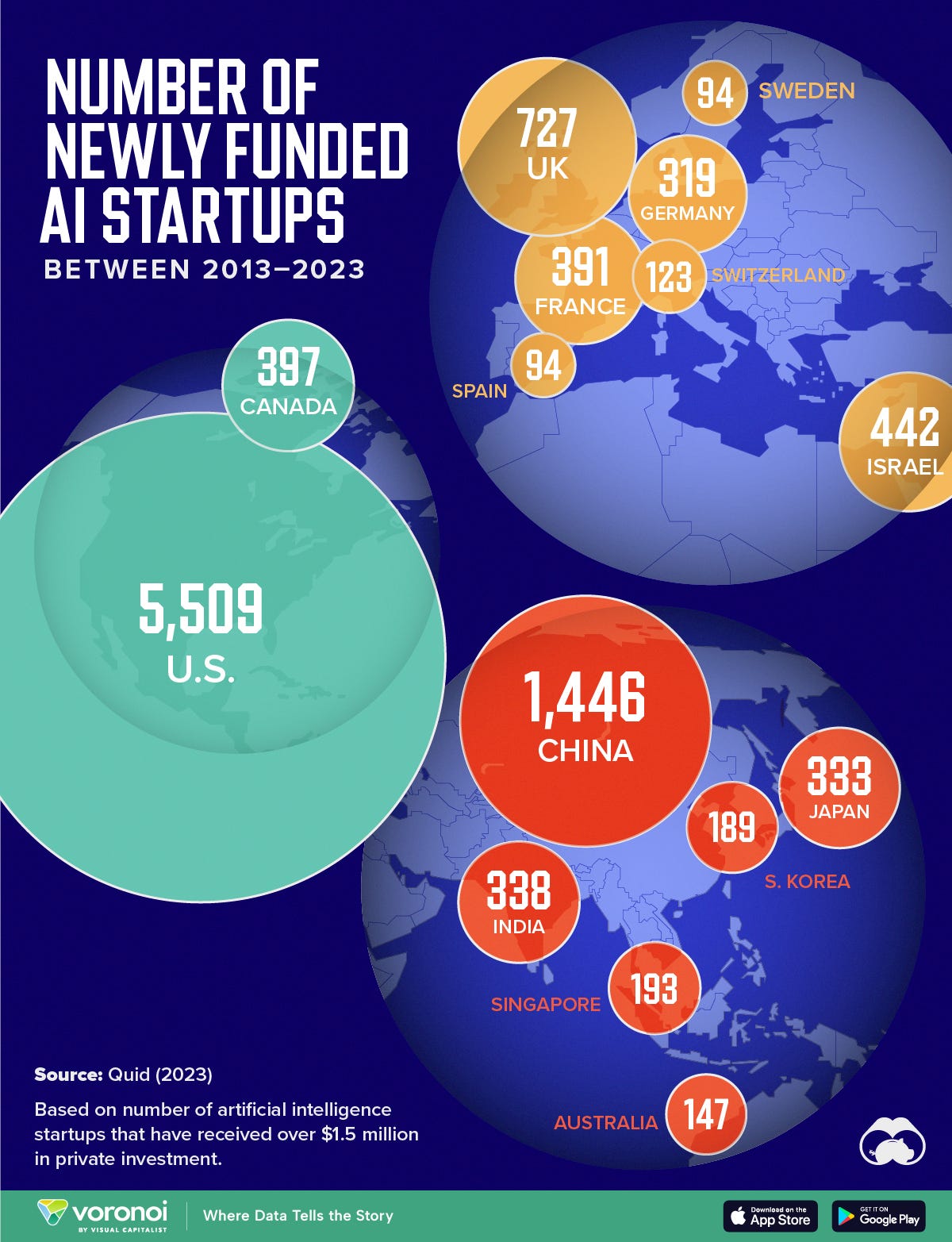

Mapped: The Number of AI Startups By Country. The figures in this graphic represent the number of newly funded AI startups within that country, in the time period of 2013 to 2023. Only companies that received over $1.5 million in private investment were considered 🌍 [Visual Capitalist]

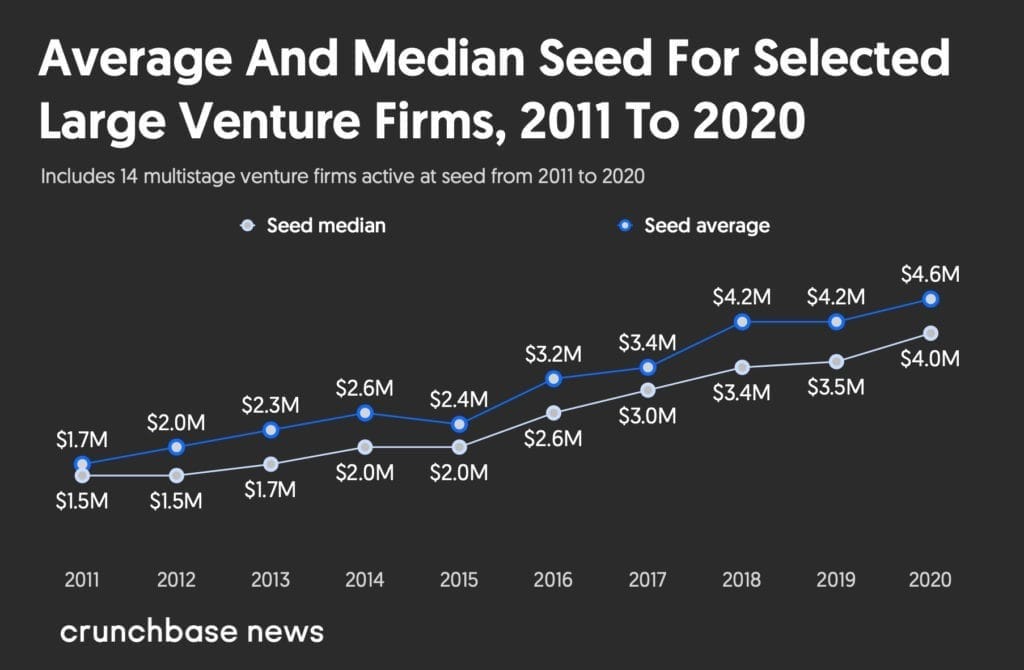

Seed is broken. Here’s how to fix it. Seed is a different game now than it was 10 years ago, for both founders and investors. It deserves a rethink 🌱 [Mattias Ljungman]

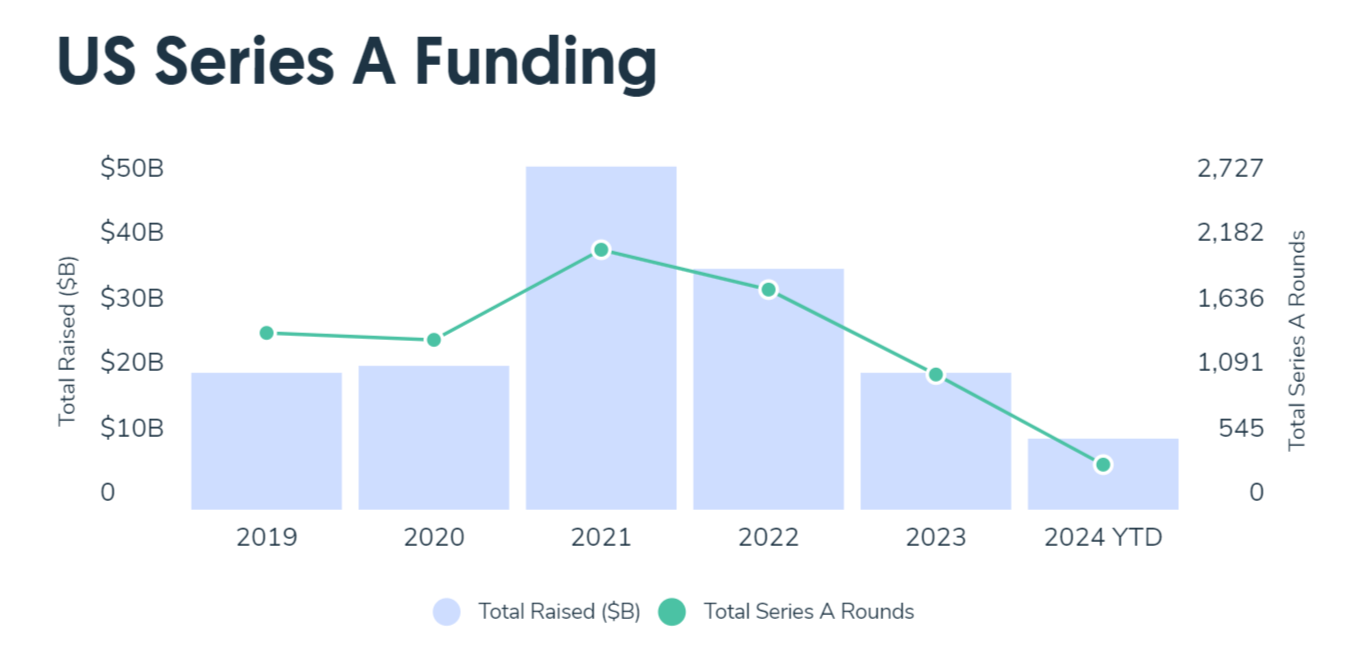

Health And Biotech Startups Now Get The Majority Of US Series A Funding. So far in 2024, biotech and health companies have pulled in around $5.6 billion across 110 Series A rounds, per Crunchbase data. That accounts for 53% of all funding at the Series A stage, which is a closely watched barometer for the startup ecosystem 🧬 [crunchbase]

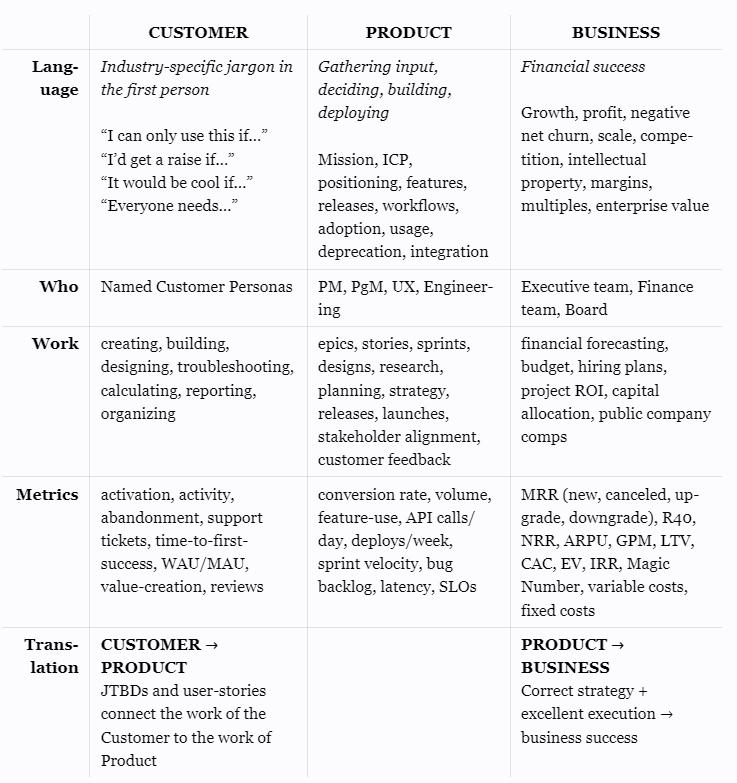

Disentangling the three languages: customers, product, and the business. Stop talking past each other. Translate between the three “languages” of customer desires, product features, and business goals 🔄 [Jason Cohen]

Tax Cuts and Innovation. The meta-scientist notices that some types of science funding are tens if not hundreds of times more effective than others 🔬 [Maxwell Tabarrok]

Thanks to your support, we’ve reached 29,000 subscribers in the 6 first months of The VC Corner, and we're just getting started 🎉

To celebrate, we're offering the first 100 users who redeem the offer a 20% lifetime discount to become a premium subscriber. Don't miss out ;)

Interesting Reports 📊

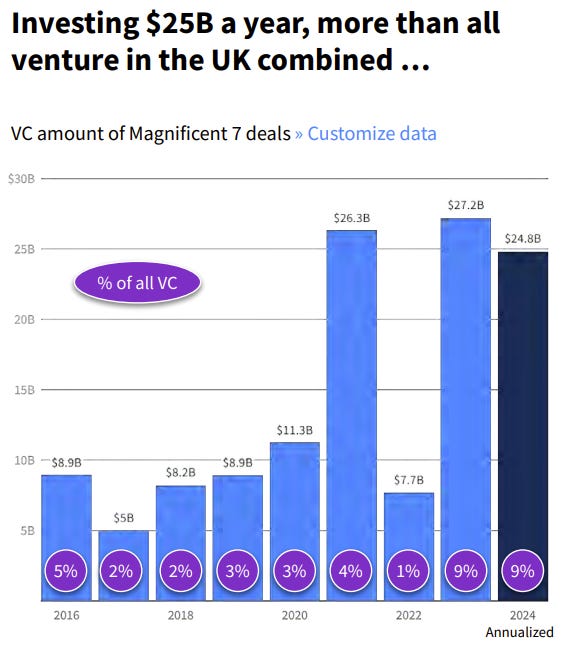

The Magnificent Seven – The Venture Capital frontier & the new AI Wild West 🤠 [Dealroom.es]

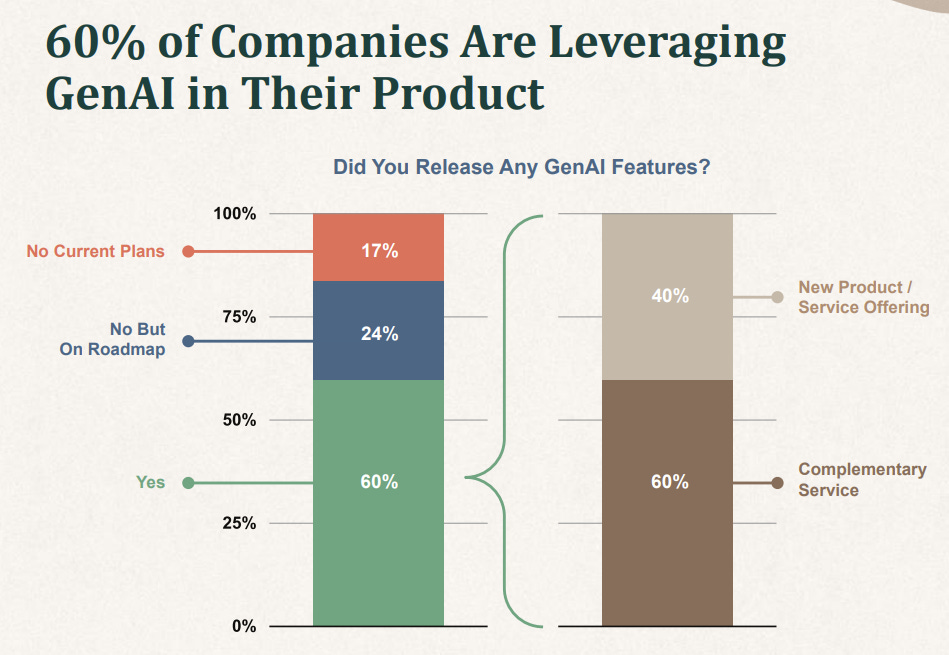

Beyond Benchmarks 2024. Key data and insights from the current enterprise cloud market ☁️ [Emergence]

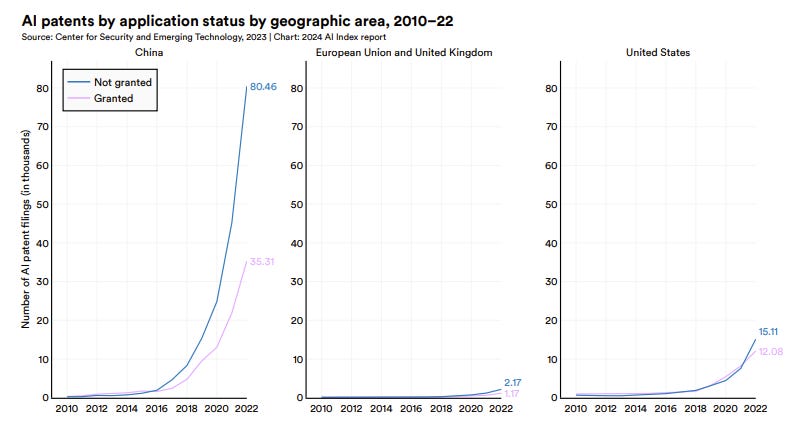

The AI Index Report. Measuring trends in AI 📈 [Stanford]

Want to get your brand in front of 29k founders, investors, executives, and startup operators? Fill out this quick form for details on our sponsorships, and we’ll contact you.

Hottest Deals 💥

Google invests $350 million in Indian e-commerce giant Flipkart, becoming the latest high-profile name to back the Walmart-owned Indian e-commerce startup.

French gigafactory startup Verkor secures €1.3bn loan to finance its gigafactory plant in northern France, bringing its total financing to more than €3bn. The Verkor site is one of five gigafactories set to be built in France, part of Europe’s push to secure its electric vehicle supply chain.

AI translation startup DeepL raises $300m at $2bn valuation. The round comes after a successful year where it was one of five companies in Europe to hit a billion-dollar valuation in 2023

Syre, a Stockholm, Sweden-based textile impact company, raised $100M in Series A funding.

Recently Launched Funds 💸

Harlem Capital is raising a $150 million fund. If raised, this new fund, the firm’s third, would be its largest to date. In 2021, Harlem Capital raised an oversubscribed $134 million, much more than the $40 million it raised for its inaugural fund in 2019.

Zero Carbon Capital, a Havant, UK-based deep-tech climate investor, has closed its £20M fund. Led by Founders and Managing Partners Pippa Gawley, and Alex Gawley, ZCC invests in European pre-seed and seed-stage companies developing hard-science solutions to the critical challenge of decarbonisation.

XGEN Venture Closes First Life Science Fund, at €160M. The firm will be working alongside scientists and entrepreneurs to create and invest in up to 15 companies, delivering solutions to patients through new therapeutics, medical devices, diagnostics and digital health solutions.

Squared Circles, the venture studio that invested in Nutrafol and incubated brands including Magic Molecule and Kelly Slater’s Freaks of Nature, has raised $40 million in a Series A fundraising round led by L Catterton.

Upcoming Events 📅

The LP/VC relations event | Vienna | Jun 1-6

Founder Friends in NYC #TechWeek | New York | Jun 3

Pitch&Drink with P2S.vc | London | Jun 3

Shoptalk Europe | Barcelona | Jun 3-5

SuperVenture | Berlin | Jun 4-6

SuperReturn International | Berlin | Jun 4-7

The UK’s festival of innovation, industry, and investment | London | Jun 5-6

Carpathian Startup Fest | Jun 5-6

South Summit | Madrid | Jun 5-7

Young VCs - South Summit | Madrid | Jun 6

Silicon Valley Summit 2024 | Jun 11-13

Digital Enterprise Show | Málaga, Spain | Jun 11-13

Responsible Investor Europe | London | Jun 12-13

EIT Food Founders Day | Bilbao | Jun 20

Techsylvania 2024 | Cluj-Napoca, Romani | Jun 26-27

Colombia Tech Week | Bogotá | Aug 26 - Sep 1

The Drop | Malmo | Sep 17

Super Climate | New York | Sep 24

sifted summit | London | Oct 2-3

How would dilution play out with 2 seed rounds? Would this mean founders could lend after series A with less than 50% stake and funds should accept that easier?

Thank you for sharing the major news about Google's investment in Flipkart and DeepL's financing.