Our startup totally isn't raising right now, but if you want, we can give you access to our fully up to date Virtual Data Room (VDR). Oh that’s so embarrassing, we forgot to scrub “For Keith Rabois eyes only” from the header, please don’t tell anybody that he’s also interested...

Less than 1% of American small businesses raise venture capital funding; that percentage is much lower worldwide. Assuming you are not Adam Neuman, founders going out to raise should acknowledge that the odds of landing a term sheet are not in their favour. Spending countless months fundraising is a major distraction for the business, even if you do manage to get funded. This is why you must be thoughtful and deliberate before you start your raise. This article will show how you can streamline your fundraising process and increase your likelihood of landing a term sheet from dream investors.

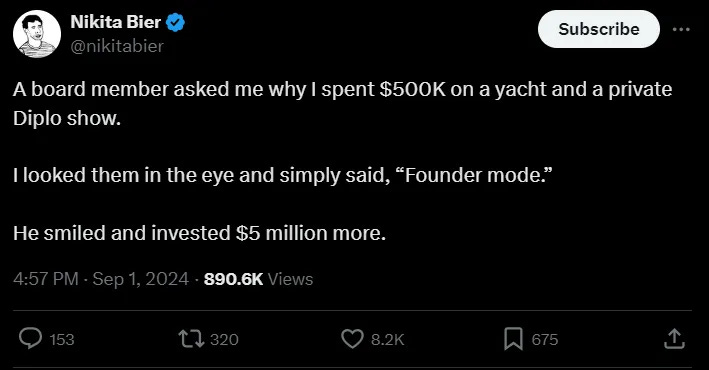

For some, fundraising comes easily. Investors are looking for startups with the potential to quickly grow into industry leaders. The strength of the founding team is one of their most important cues. This is why when they believe they have identified a founder or a team that they believe in, they will quickly move mountains to back them. This is why well-known figures such as Ilya Sutskever, Travis Kalanick, and Adam Neumann can raise hundreds of millions or billions of dollars before a single line of code is written.

They are unfortunately the exception, and not the rule. Their celebrity-like status within their respective verticals, mean they are known to every investor and don’t need to put as much effort into looking for investors. For everybody else, finding the right pool of investors requires a lot more diligence.

In this article and a subsequent post, we will cover the following:

Identifying potential investors

Making contact

Communication before the fundraising process

Preparing for the fundraise

What to include in your pitch deck

Structuring your Virtual Data Room (VDR)

Running the fundraise process

Staying connected after the fundraise

1. Identifying potential investors:

OpenAI co-founder Ilya Sutskever, who left OpenAI in May 2024, has raised $1 billion from investors for his new AI company, Safe Superintelligence, or SSI at a reported valuation of $5 billion dollars. (Reuters, September 4th 2024)

There are tens of thousands of investment firms, family offices, syndicates, and corporates that invest in early stage companies (See The Ultimate Investors List of Lists). Despite the total pool of inventors being very large, only a small percentage can be a potential investor in your company. This is similar to the difference between TAM and SOM that we covered in the Market Sizing 101 article. To avoid wasting time and energy, you want to focus on investors where your company falls within their investment criteria.

The investment criteria are the parameters that define an investor’s potential investment targets and they typically are broken down by:

Stage: (Seed, Series A-B, Growth Stage)

Geography: (US only, North America, Europe, Global)

Industry Vertical: (B2B Saas, AI, Consumer, Crypto, Marketplaces)

Revenue: (>$100K ARR, >$1M, >$10M, >$20M etc.)

Some investors will explicitly list this criteria on their website but if not, you can usually get an idea by looking at their portfolio companies to see if there is a common theme across their investments. If an investor normally invests in large established fintech companies based in the US, they are unlikely to invest in an early stage European Health Tech startup.

This is why before speaking with an investor, you should know if you fit within their criteria and whether they could be a candidate to invest in your next round. You should not turn down the opportunity to speak to funds that invest at later stages since they can offer helpful feedback or introductions to other investors, just don’t count on them to write a check at this stage.

Each investor might have a different definition of what they consider seed, series A, etc. Their firm's appetite can also change over time, which is why despite what they announce on their website, it’s worth meeting to validate if you could be a fit.

While there is a qualitative aspect to it, here are the approximate revenue ranges for each funding stage:

Seed: Pre-Revenue up to $1M ARR

Series A: $1-5M

Series B: $10-15M

Series C: $20M+

2. Making contact:

Before raising their first round of funding from Sequoia Capital and Y Combinator, Airbnb was rejected by countless investors for more over a year. To stay afloat, they created and sold limited edition presidential election cereal boxes to stay afloat until they could secure funding.

“We pitched to hundreds of investors, getting rejected time and time again . . . I was quite literally living on my brother’s floor,” Canva founder, Melanie Perkins

Once you have identified a list of investors you believe could be interested, you should go to your network to see if you have any mutual connections. Although only 1% of companies ever raise venture capital, many more try. This results in prominent VCs getting inundated with inbound deal flow but not having enough time to meet with all of them. If you are introduced to them by a respected contact, ideally another well regarded founder, they are far more likely to give you their attention compared to an unsolicited cold email.

Keep reading with a 7-day free trial

Subscribe to The VC Corner to keep reading this post and get 7 days of free access to the full post archives.