For those new to my writing, I’m Akash, partnering with founders at the earliest stages at Earlybird Venture Capital.

Software Synthesis is where I connect the dots on software and company building strategy. The writing ranges from how AI affects software companies, to how companies can successfully go multi-product, to deep insights on the state of software GTM. These pieces are in service of the founders that I’m lucky enough to be supporting and meeting every day.

You can reach me at akash@earlybird.com if we can collaborate. If you enjoyed this, feel free to share it with your friends!

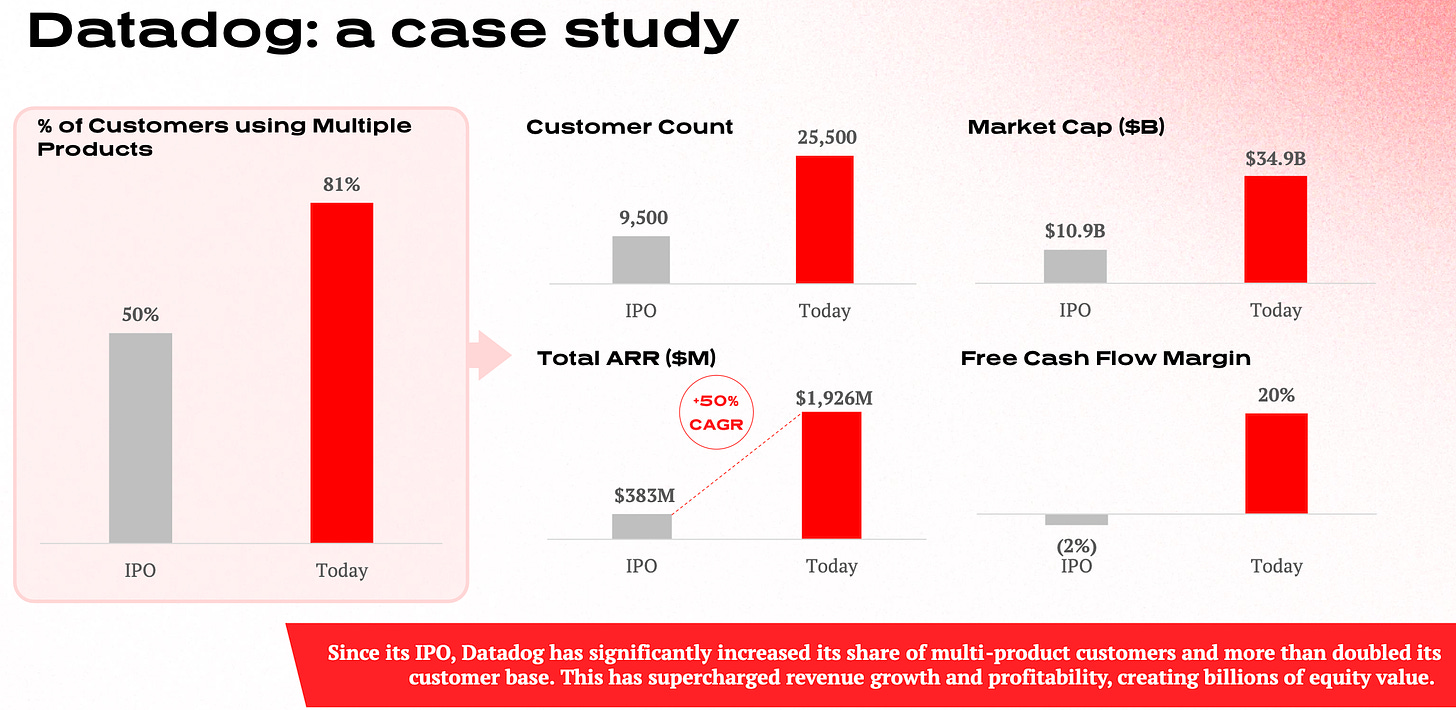

‘To go public, companies need to be at least $200-400M ARR, insanely efficient with >30% growth at scale, generating free cash flow, and have the beginnings of a multi-product engine to upsell like Datadog, Crowdstrike, Palo Alto Networks and others.’

Ed Sim

‘As of this writing, again according to Lone Pine’s work, 78% of public companies with > $5bn of market cap are multi-product.

Those that aren’t multi-product will have to resign themselves to bounded outcomes and acquisition by a Platform of Compounding Greatness. Based on Lone Pine’s research, approximately ⅓ of the public single-product companies as of the end of 2016 were acquired by the end of 2022.’

Tidemark

I’ve written before about how going multi-product is destiny for companies aspiring to become compounders at scale as they transition from private to public markets.

As we see point solutions become share donors to multi-product platforms, it’s easy to forget the beginnings of these compounders.

I recently came across the ‘Wayback Machine’, an archive of webpages, which helps us travel back far enough to see just how yesterday’s David became today’s Goliath.

I found it a useful exercise to do this for a handful of companies across different investing vintages that are generally considered successful multi-product platforms, namely:

ServiceNow

Datadog

Hubspot

Stripe

Rippling

Lattice

Snapshots of each company’s website at specific points in its history as it graduated from single product to platform are instructive for founders at the earliest stages plotting their own path from their first product to the second, third, and nth product.

For some companies like Hubspot the next product came post-IPO, whilst recent examples like Rippling intentionally pursued a compound startup strategy from inception. Cookie-cutter advice on timing product expansion is marginally helpful, as the right timing can vary widely across software categories.

What matters is to have a plan and reflect on what that next product should be and when is the right time for it.

Markets may gyrate, but multi-product companies’ ability to generate free cash flow is evergreen.

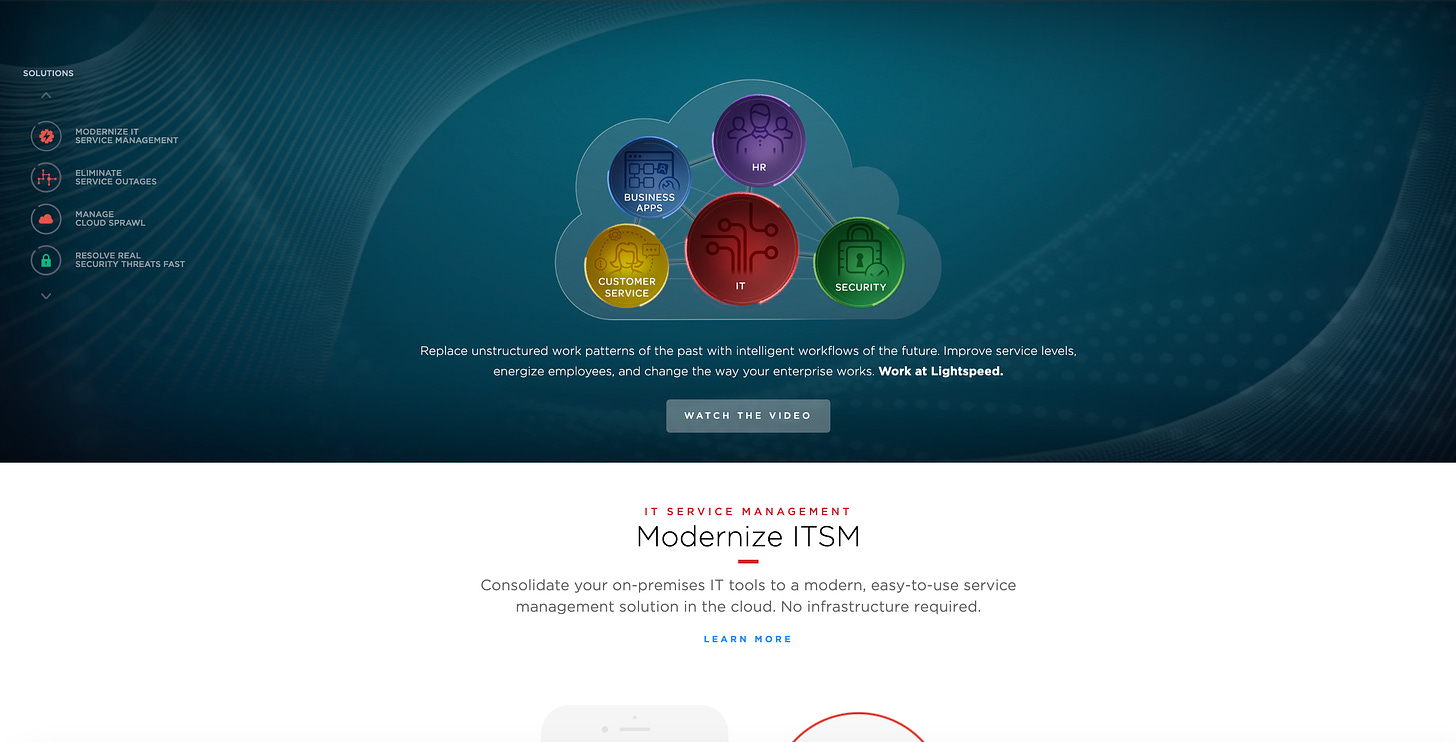

ServiceNow

ServiceNow IPO’d in 2012 and drew scepticism about its TAM, then perceived to be restricted to a sluggish IT Service Management market.

Frank Slootman catalysed ServiceNow’s multi-product journey in 2014, and the results of this were materialising by the time he left in 2017 - non-IT workflows comprised over 20% of revenue.

For a company projected to reach nearly $11bn in revenue in 2024 (that derived over half its revenue from non-IT services in 2021, a ratio that only continues to increase), that is flawless execution.

Datadog

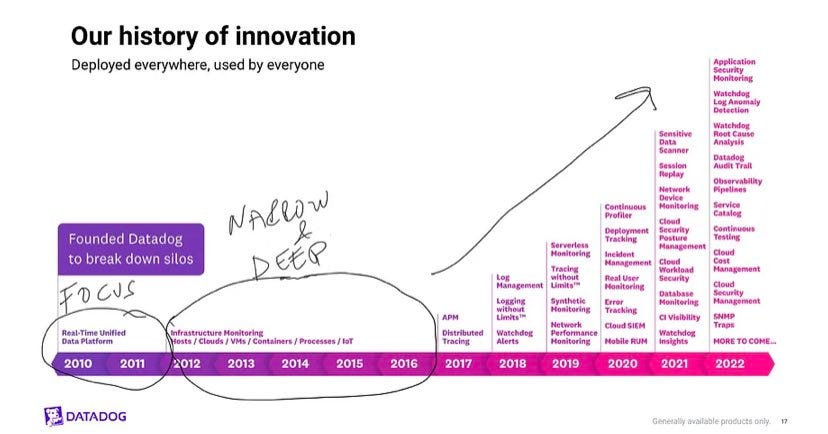

Datadog is the archetypal multi-product company that has to go slow to go fast - the mission criticality of Datadog’s product meant that the opportunity cost of allocating R&D dollars into new products prematurely was too high.

Datadog earned a right to expand at a certain point - that point varies by the proximity to mission criticality. The closer to mission critical your software is, the longer incremental R&D dollars will have to be invested into the core product.

When that point does come though, few vendors will have the same gross retention and right to consolidate.

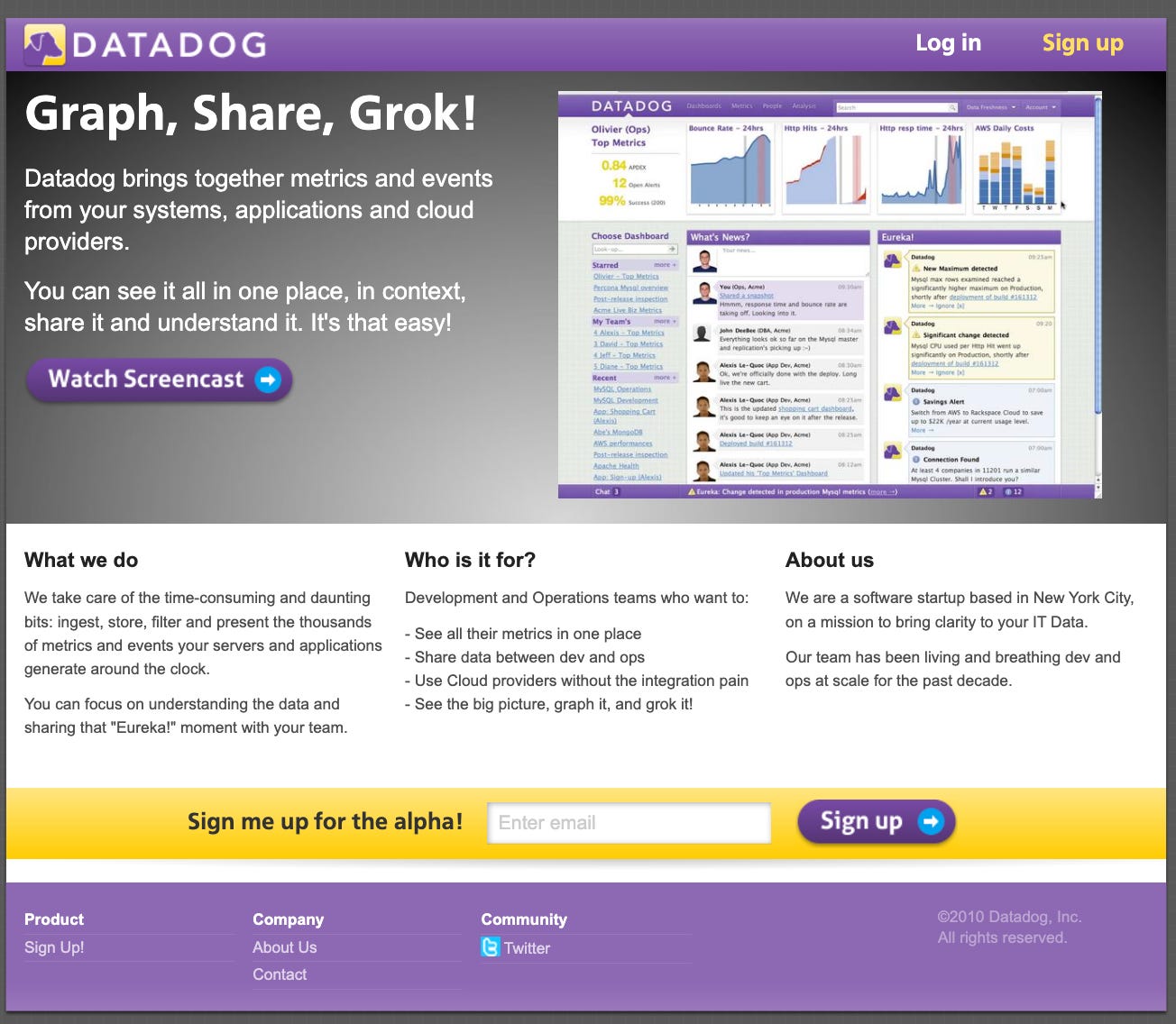

Datadog’s earliest days betray modest ambitions..

Fast forward to 2017, their multi-product engine kicked into gear, and it’s continued to hum along nicely to this day with a new shift to build for.

Hubspot

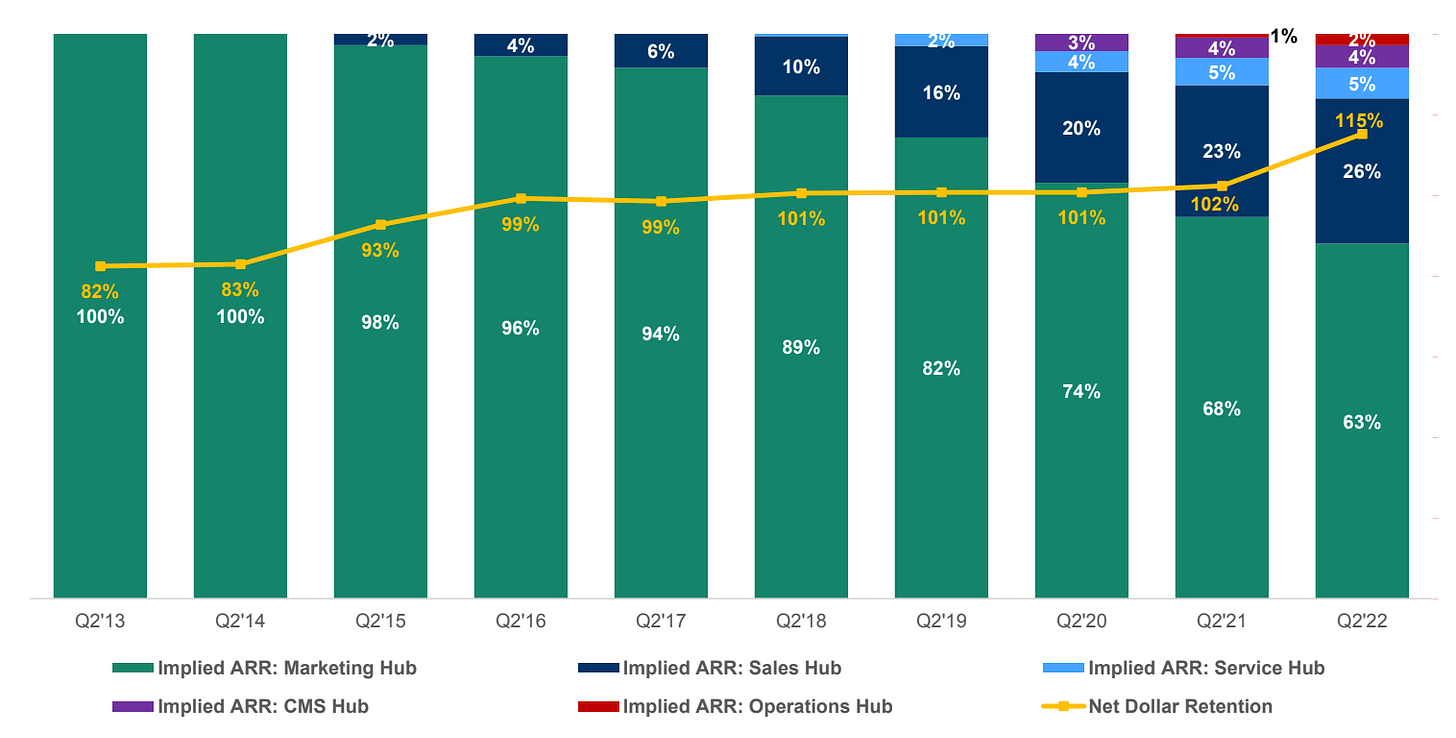

Meritech’s case study on Hubspot’s multi-product journey is worth your time, if only to come away with the lesson that companies can ride sheer GTM excellence into the public markets.

Hubspot’s additional products only kicked in from 2015 onwards, after its IPO in October 2014, and only crossed > 20% of ARR in 2019..

At the earliest stages, message-market fit precedes product-market fit (and various other pieces of the puzzle that need to fit together).

You can see what parts of the message are constant and which change as a company morphs into a multi-product suite..

What comes next?

Stripe

Rippling

Lattice

BONUS: Multi-Product Adoption

BONUS: Multi-Product in the AI Age

Reading List

Keep reading with a 7-day free trial

Subscribe to The VC Corner to keep reading this post and get 7 days of free access to the full post archives.