Venture capital often feels like a mystery to founders—a world where game-changing decisions happen behind closed doors, and securing investment can seem like a shot in the dark.

But what if you could step inside that room and understand the precise factors that VCs weigh before making their decisions?

In this article, I’ll break down exactly how venture capitalists approach their investment process, based on deep analysis of one of the most insightful reports (I’ll share it later) on VC decision-making. From sourcing deals to adding post-investment value, I’ll take you through the 13 critical steps every VC follows on their journey to backing the next billion-dollar company.

This isn't just surface-level information. I’m diving into the key details that drive every phase of the investment process: what VCs look for in teams, how they assess market opportunities, the deal terms that matter most, and what ultimately separates successful startups from the rest.

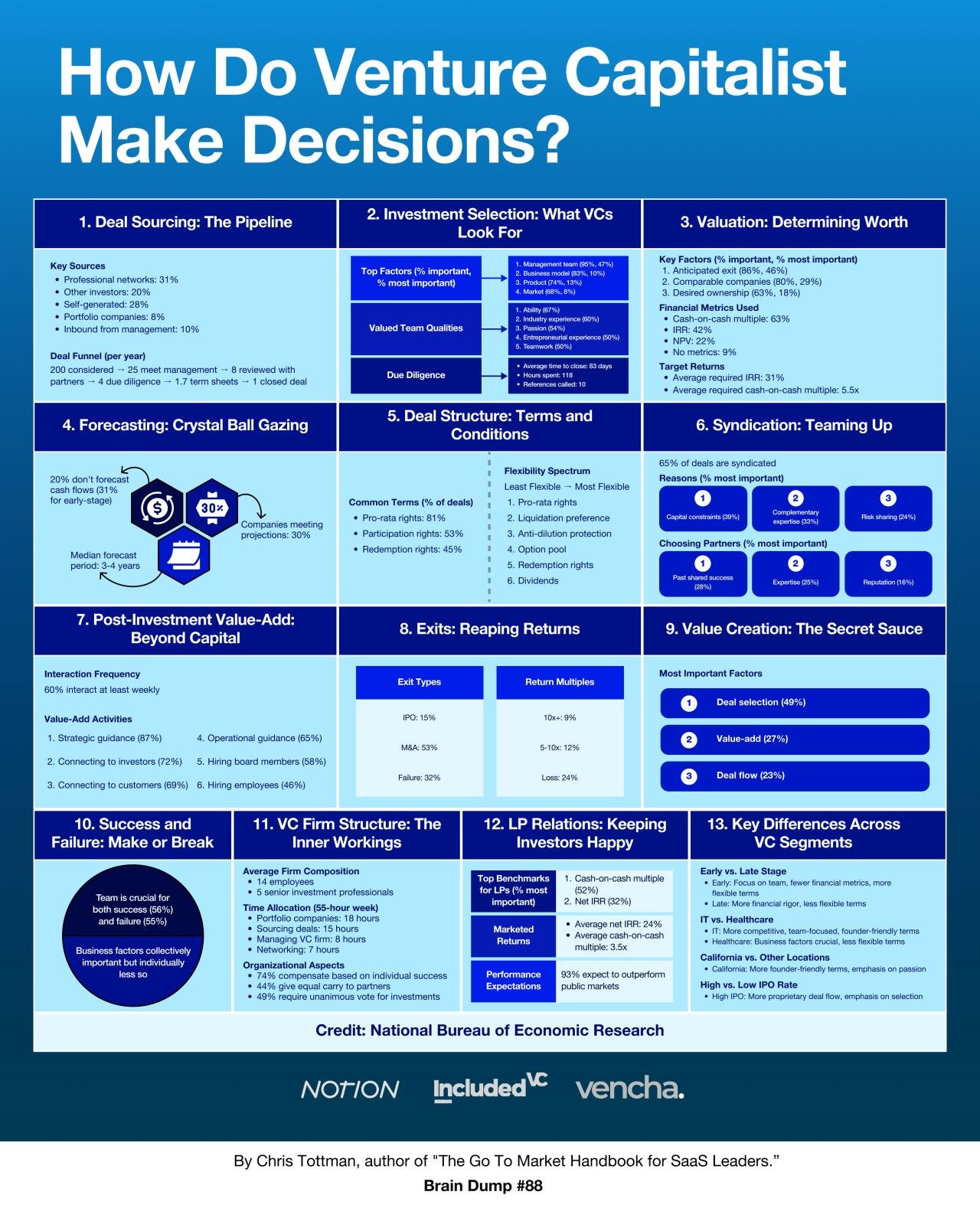

Below, you’ll find a powerful summary in the form of an infographic by Chris Tottman that outlines these steps. From there, each section of the article digs deeper into the specifics, giving you the actionable insights you need to sharpen your fundraising strategy and approach investors with clarity.

If you're ready to gain the kind of knowledge that can dramatically shift how you navigate the venture world, this is the article to read.

Every piece of insight here is designed to empower founders to understand not just what VCs do, but why—and how you can leverage that understanding to your advantage.

1. Deal Sourcing: The Pipeline 📜

In venture capital, finding the right deals is where it all begins. And as it turns out, deal sourcing is more of an art form than a science. VCs don’t just stumble upon high-potential startups; they cultivate vast networks that help them get a steady flow of opportunities.

Key Sources

The best deals often come from professional networks (31%)—relationships built over time with industry insiders. These could be former entrepreneurs, other VCs, or advisors who have seen the game played out from multiple angles. Interestingly, other investors are the second most important source (20%), meaning VCs often collaborate, relying on each other's expertise and connections to unearth new opportunities.

Self-generation (28%) and inbound pitches from management (10%) round out the rest of the pipeline. Self-generation includes cold outreach and proactive targeting of founders or companies VCs find interesting. These numbers show how selective the process is—only a small percentage of deals come through inbound pitches.

The Deal Funnel

VCs are overwhelmed with deal flow. The median VC firm reviews around 200 deals per year. Of these, they might move 8 to partner-level discussions, dive into 4 for serious due diligence, and ultimately close just one deal. That’s a tight funnel. The implication here is clear: startups need to be remarkable to even get a foot in the door.

2. Investment Selection: What VCs Look For 🎯

If deal sourcing is where the journey starts, investment selection is where VCs decide if a startup is worth the plunge. The question is: What do they really care about when evaluating startups?

Top Factors

It all starts with the team. In fact, 65% of VCs rank the quality of the management team as the most critical factor in deciding whether to invest. Startups often pivot, and markets evolve—but strong founders can adapt. Investors aren't just betting on an idea; they're betting on the people behind it.

Next up is the market. A company can have the best product in the world, but if the market opportunity isn't large enough, it’s tough to get excited. Market attractiveness is the second most crucial factor. VCs want startups that are tackling problems in large or rapidly growing markets.

The product and its ability to solve a real problem comes in third place. But make no mistake: product quality is essential—especially in tech. However, even a great product can only go as far as the team driving it and the market it's serving.

Due Diligence

Once a startup catches a VC’s eye, the due diligence process begins. This involves a deep dive into the company's financials, customer base, technology, and founder backgrounds. VCs will also look into the competitive landscape to ensure the startup can defend its position and grow within its market.

But here's the thing: Due diligence isn’t just about checking boxes. It's about confirming the initial gut feeling that the startup is a winning bet.

3. Valuation: Determining Worth 💵

After deciding that a company is worth the time and energy, the next question is: How much is it worth? Valuation is the critical point where VCs and startups have to come to an agreement. Too high, and the deal might fall apart. Too low, and the founder could feel short-changed.

Key Factors in Valuation

When VCs value a company, they look first at anticipated exit opportunities—basically, how and when they can cash out. 65% of VCs consider the likelihood of an IPO or acquisition to be a key determinant of value. If a company shows a clear path to an exit, its value increases.

Comparisons with competitors are also a significant factor—60% of VCs will look at how similar companies are valued to benchmark their offers. Then comes the desire to own equity—33% of VCs focus on how much equity they can own in the company, balancing risk and reward.

Financial Metrics Used

When it comes to hard numbers, VCs rely on cash-on-cash multiples, typically targeting a 5.5x return. This means if they invest $1M, they expect to get $5.5M back. Other financial metrics like IRR (Internal Rate of Return) and NPV (Net Present Value) are considered but tend to take a backseat for earlier-stage investments.

Target Returns

For early-stage deals, the numbers might seem ambitious. VCs often expect a 31% IRR on their investments, reflecting the high risk they’re taking by backing companies at such an early stage. However, they understand the risks and know that for every unicorn, there will be several failures.

4. Forecasting: Crystal Ball Gazing 🔮

Once the valuation is set, it’s time for VCs to look into the future. Forecasting in venture capital is part art, part science. It's about predicting how a startup will perform in the coming years—a critical factor in deciding whether the investment will actually pay off.

What VCs Expect

Still a free subscriber?

Upgrading to a premium subscription will give you access not only to these invaluable article but also to the entire archive of articles published on The VC Corner. You'll gain insights, resources, and strategies that have already helped thousands of founders and VCs.

To continue reading the article, you can become a premium subscriber or take a 7-day free trial 👇

Keep reading with a 7-day free trial

Subscribe to The VC Corner to keep reading this post and get 7 days of free access to the full post archives.