Hey there! Welcome back to The VC Corner. Today, we're diving deep into financial modeling—a crucial skill for any founder looking to secure investment and manage their business effectively.

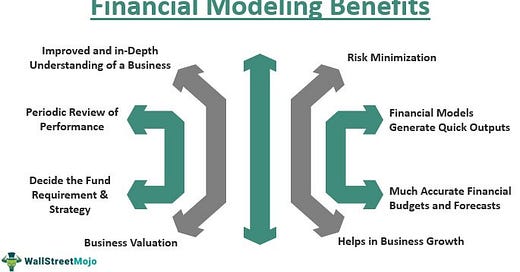

Financial modeling might sound intimidating, but it's all about telling your startup's story through numbers. It's about projecting your company's future performance based on assumptions about revenue, expenses, and growth. A solid financial model can help you raise capital, make informed decisions, and steer your startup toward success. Let’s break down the essentials.

Why Financial Models Matter

Before we get into the nuts and bolts of building a financial model, let’s talk about why they’re so important. There are two main reasons:

Raising Money from Investors: Investors want to see a clear picture of your startup's financial future. A well-constructed financial model shows them how you plan to grow, how much money you’ll need, and how they’ll get a return on their investment.

Managing Your Business: A financial model isn't just for investors. It’s a vital tool for you as a founder. It helps you test different business strategies, forecast cash flow, and ensure you’re not running out of money.

Key Components of a Financial Model

A good financial model usually includes three core financial statements: the Income Statement, the Balance Sheet, and the Cash Flow Statement. Let’s break these down.

1. Income Statement

The Income Statement summarizes your revenue, costs, and profits over a specific period. It answers questions like: How much revenue did we generate? What were our costs? How profitable are we?

Revenue: Start with your revenue streams. How do you make money? List out each source of income.

Cost of Goods Sold (COGS): These are the direct costs of producing your products or services.

Gross Profit: Subtract COGS from revenue.

Operating Expenses: Include things like salaries, rent, and marketing expenses.

Net Profit: What’s left after all expenses are deducted from revenue.

2. Balance Sheet

The Balance Sheet provides a snapshot of your company’s financial position at a specific point in time. It shows what you own (assets) and what you owe (liabilities).

Assets: These are things like cash, inventory, and property.

Liabilities: These include loans, accounts payable, and other debts.

Equity: This is the difference between your assets and liabilities. It represents the ownership value in the company.

3. Cash Flow Statement

The Cash Flow Statement tracks the cash flow in and out of your business. It’s divided into three parts:

Operating Activities: Cash generated or used in the core business activities.

Investing Activities: Cash used for asset investments, like equipment or property.

Financing Activities: Cash from investors or loans, and cash paid out to investors.

Building Your Financial Model

Now, let’s get practical. Here’s a step-by-step guide to building a simple financial model.

Step 1: Define Your Assumptions

Keep reading with a 7-day free trial

Subscribe to The VC Corner to keep reading this post and get 7 days of free access to the full post archives.